Homeowners Insurance in and around Centerville

A good neighbor helps you insure your home with State Farm.

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

- Richmond, Indiana

- Connersville, In

- Greenville, Ohio

- New Castle, Indiana

- Eaton, Ohio

- Cambridge City, In

- Liberty, Indiana

- Cincinnati, Ohio

- Indianapolis

- Dayton, Ohio

- Centerville, Indiana

- Hagerstown, Indiana

- Muncie

- Wayne County Indiana

- Preble County, Ohio

- Darke County, Ohio

- Winchester, Indiana

- Henry County, In

- Hamilton, Ohio

- Brookville

- Celina, Ohio

- Rushville

- Versailles, Ohio

- Greenfield, Indiana

What's More Important Than A Secure Home?

Your house isn't a home unless you're protected with State Farm's homeowners insurance. This fantastic, secure homeowners insurance will help you protect what you value most.

A good neighbor helps you insure your home with State Farm.

Apply for homeowners insurance with State Farm

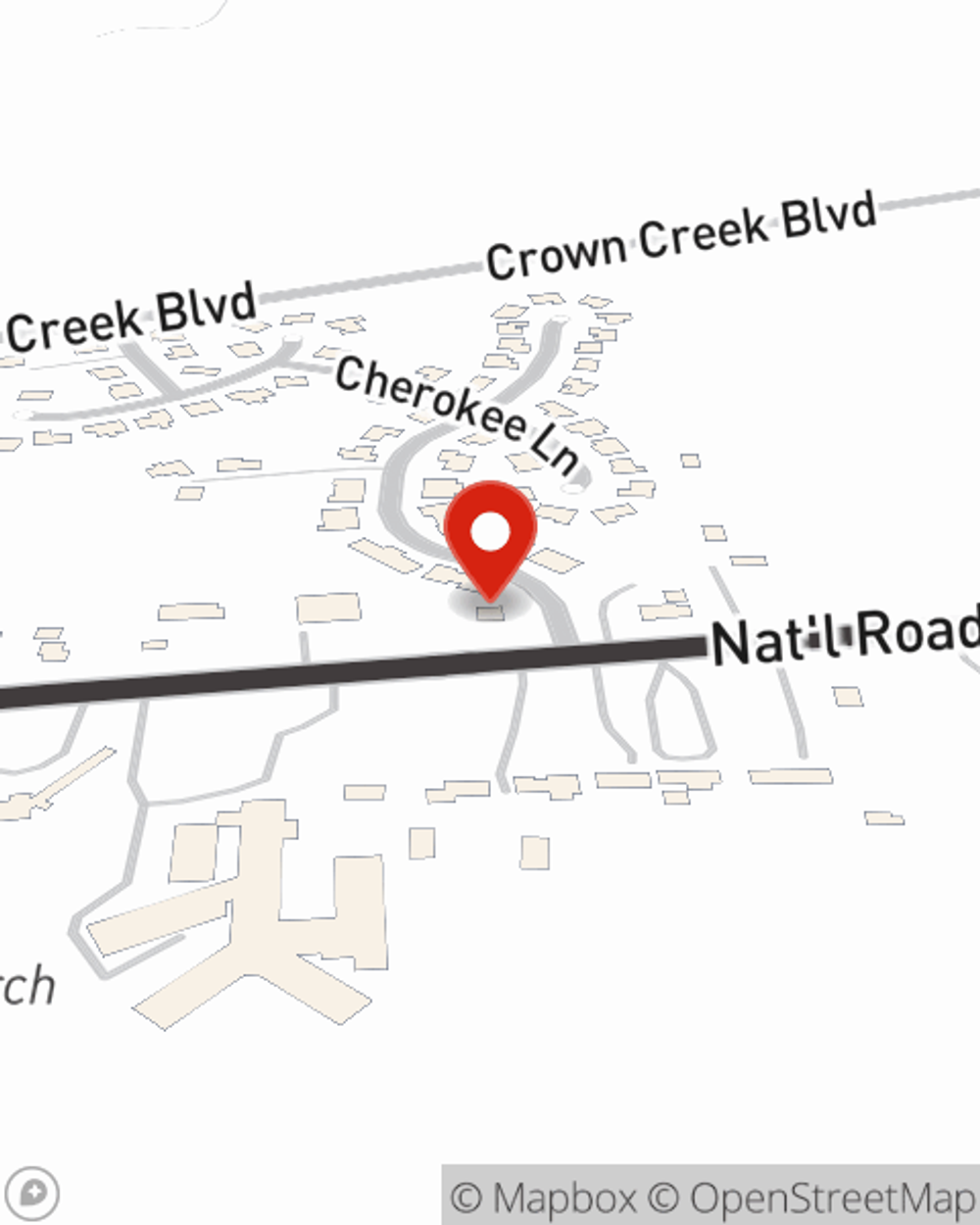

Agent Jason Stewart, At Your Service

Agent Jason Stewart has got you, your home, and your memorabilia shielded with State Farm's homeowners insurance. You can call or go online today to get a move on generating a plan that fits your needs.

Your home is important, but unfortunately, the unpredictable circumstance is not off the table. That's why you need State Farm's homeowners insurance. Plus, if you need some more air space, our bundle and save option could be right for you. Jason Stewart can help you get the information you need!

Have More Questions About Homeowners Insurance?

Call Jason at (765) 439-4024 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Jason Stewart

State Farm® Insurance AgentSimple Insights®

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.